Logtar recently stirred up the pot a little on his blog by commenting on the evils of recent Republicans. That’s all well and good. There’s plenty of stuff for everybody to point fingers at. What got me riled up enough to participate repeatedly in the conversation that followed in his comments section was the notion that increasing taxes removes the incentive for people to do well, to outperform, to excel in their fields.

At first blush, this certainly makes sense: why should I try harder if I won’t get rewarded extra for it? Ah, but that isn’t what actually happens. If I bust my tail to make an extra $10,000 this year, the government will take away a portion of it. Let’s assume I am in the highest possible tax bracket already (because that is the strongest the tax deterrent gets, the deterrent is less pronounced at lower brackets). That means of the additional $10,000 I worked my keister off for, I have to give $3,500 of it to Uncle Sam. Those bastards. How dare they? Why did I waste my time? Oh yeah, because now I’m $6,500 richer for my efforts, have improved my standing with my coworkers and employer, elevated my reputation in my industry, made my kid proud of how awesome his dad is, and the thousand other reasons (including income) that I try to do well at my work.

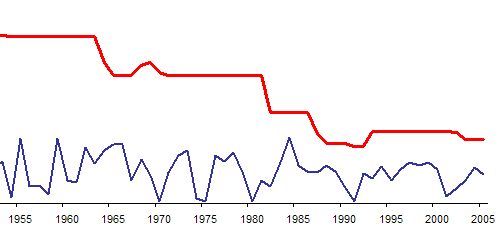

The chart at the top of this post shows the top marginal income tax rate in the United States from 1930 to 2005 (in red, the aggressive color of the evil government stealing your money) compared to the year-to-year percentage change in gross domestic product (in blue, the serene and peaceful color of economic progress and the production of wealth). Due to the sharp differences in scale, I put the GDP on a logarithmic scale. Forgive me. I put it together to see whether the common-sense argument really holds up. During my entire politically-aware life (from the later Reagan years onward) I’ve heard the same thing over and over again: the economy is being strangled by the tax system. High taxes are stifling our economy, preventing investors from doing their part, preventing businesses from expanding and innovating, and preventing small start-ups from hiring new employees and keeping our economy healthy.

The numbers don’t seem to support this. We see that when taxes are at or above 70% for the top income-earners, we see similar growth as when those taxes are are or below 45%, with wild variations that make it difficult to draw any causal correlation here at all. We know that when the tax rate on top-performers is 100% plus a trip to the GULAG (the old Soviet system) things don’t pan out that well, but when it’s 91% and the accolades and respect of the community, it seems to go pretty well.

Standing on soapboxes claiming that the nasty liberals are going to take away your cheese is, at best, bullshit. The problem isn’t how much the government takes from your paycheck, it’s what it turns around and spends the money on and whether we’re getting a good return on our investment. When Eisenhower used tax funds to build the highway system, private enterprise was able to take advantage of new infrastructure to build, expand, and optimize their private endeavors. When vocational training and after-school programs help kids stay out of trouble and get jobs, we don’t need to spend as much money policing and jailing. When billions of dollars just up and disappear because some government contractor isn’t keeping track of anything and nobody’s minding the shop in Washington, we just plain lose out.

I still stand by my comments that taxing and regulating the crap out of business or a person has a negative effect. Examples from the 50’s do not apply because now it’s just as easy to move your money and/or production to a different country and it was almost impossible until 20-30 years ago. By now large part of the manufacturing is already gone, being slowly finished off by things like Boeing strike. Many businesses already incorporated off-shore and it will continue as a trend. Also the definition of “rich” or “top 5%” or whatever moved down to people making $200K which is not rich anymore by any standards,esp. in California or East Coast. I think if Obama or whoever came out and said: we are shooting for the European model it would have been more honest than trying to bribe voters by promising them a cut from the wealthy. No doubt it works but my personal opinion that it’s a stupid strategy for the long run. But long run is longer than 8 years, so Obama doesn’t have to worry about it.

As with so many things, the devil lies in the details. Do we benefit from lightly-regulated industries that need not worry about environmental or workplace safety standards? Do we benefit from lightly-regulated financial markets in which, as you point out, it is increasingly easy to just shuffle your money off to an off-shore tax haven? Do we benefit from lightly-regulated international trade that encourages businesses to seek the lowest possible wages in third-world sweatshops? In a lot of ways, yes we do. Every time you buy something affordable that was made in China, you personally benefit from some guy in Ohio that got laid off and some investor that shuffled capital off to a foreign manufacturer so some half-starved politically-oppressed farmer could become a half-starved politically-oppressed factory worker.

Do we not have any appreciable textile industry any more because it was over-regulated and over-taxed, or because there were dirt-poor people in other countries willing to do the work for way less money (with plenty to spare to cover the transportation costs and tariffs)?

I think the answer is both. Yes, there are people who will work for cheap and yes, over-regulation kills business IF there is a way to escape said regulation. If we were still isolated and mostly self-sufficient as in the 50s there wouldn’t be any discussion on this subject. Reality now is different, and politicians should be cautious of overdoing their thing. At the DNC before Obama’s speech some schmuck was telling his sad story about packing his equipment and sending it to China before being laid off, and then Obama said something about bringing the jobs back, but jobs already are coming back except they are paying less than they used to. I wonder how is he going to bring $30/hr jobs back without raising the price of goods.

No governmental action, for better or worse, can be accomplished, with out tax revenue. I agree with you that, on an individual basis, increased taxation to a point, will not affect individual productivity. Everyone wants the opportunity to make more money; I don’t think people will stop working until the tax rate is a little closer to 100%.

A free market economy is based the movement of products and services from a lower relative value to a greater relative value. Dirt is cheap, get coal out of dirt and it increases its value. This is how wealth is created whether from dirt or micro chips and software. This increases the overall value in our economy. Taking money in the form of taxation moves money from a higher value to a lower value reduces the economy. Any time money is moved from productive people to pay for government programs, no mater how noble the intent, it reduces the overall value of money and thus the economy. Infrastructure is a good example of how taxed revenue can lay the foundation for more commerce but this has to be considered most carefully to avoid perpetuating the idea that we can tax ourselves to prosperity.

So taken on an individual basis, taxation is not really connected to productivity, however, in a larger sense taxation in general limits productivity. The trick is finding a balance between what we want and what we are willing to pay for.

2 cents worth, tax free.

-pf