California’s budget is a mess, and has been since the big dot-com bubble burst. This is nothing new, and has been a political campaign topic at the state level for about ten years now. I don’t post about it much, but somehow every time KC Meesha gretches about his taxes, I end up steamed and monopolizing his comment section. I totally understand where he’s coming from on paying taxes in a town where he works but doesn’t live, and delight in pointing out the fact that he’s unable to do anything about it. I think he takes it quite well.

What got my goat, however, was a flyover-dweller bitching about California looking to get a little money from the federal government to cover our budget shortfall. Specifically “I Travel for JOOLS” brought this up:

And I just ran across this little article. The money quote, California’s unionized public employees can retire at 50 and receive 90 percent of their last year’s pay FOR LIFE !

AND THEY WANT US TO BAIL THEM OUT ????

http://www.washingtonpost.com/wp-dyn/content/article/2010/01/08/AR2010010803593.html?nav=rss_opinion/columns

First, pensions are paid by the pension fund, not by the state directly. Second, she’s citing an article by George Will, who doesn’t know his ass from his elbows regarding how California spends its money. Third, she’s using all-caps, which I find obnoxious. Fourth, she’s using excessive punctuation (one question-mark is sufficient, folks). All of this just serves to raise my hackles regardless of the actual merit of her point, which is rather seductive: California is spending its way into this mess, why should the rest of the country be burdened by this?

Let’s take a look, shall we?

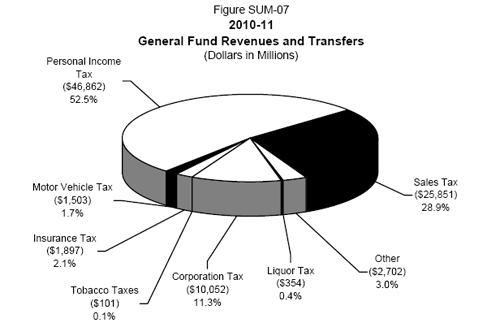

Where does California get its money? Specifically the general fund money that our congress-critters get to fiddle with every year? ebudget.ca.gov provides a nice little summary:

Mostly from income taxes and sales taxes. I see money come out of my paycheck every week on one, and see the other nearly every time I buy anything. I’d just as soon leave these alone or lower them.

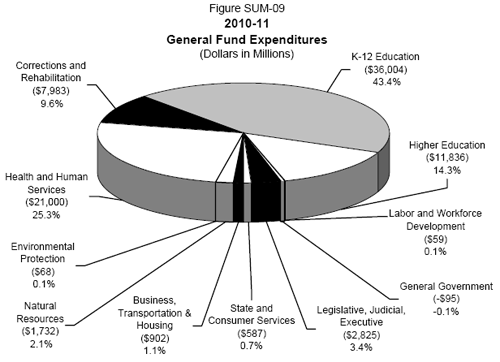

Where does the money go? Again, ebudget provides a summary:

Education takes up almost 58% of the state budget. Ouch. That looks like a great place to look for fat to trim. It’s also a political landmine to go anywhere near that portion of the budget without alarming reactionary parents and grandparents. Grandparents vote, you see.

Health and Human Services makes up the next biggest slice of general fund, at about $21,000,000,000. This is the nebulous government waste that I think most libertarians and tea-party types are talking about most of the time that they whinge about government waste. If the federal congress were actually trying to fix health care, this could have been reduced significantly (partly through increase systemic efficiency but largely through federal spending). But they aren’t.

Which brings us to: where the hell is all my tax money going?

I pay my taxes like a good citizen. I look for whatever deductions and credits I may be legally eligible, of course, but I understand that taxes are the price I pay for having a variety of safeguards and comforts that many others in the world don’t enjoy (into religion? love guns? hate paying taxes? you’d love it in Somalia!). But the bulk of the money coming out of my paycheck doesn’t go to Sacramento. It goes to Ogden, Utah. Where the IRS collects my annual 1040 form. So what happens to Californians’ federal tax money?

On the California income tax table, if you earn $70,000 a year (median income for a family of four in the state), and you somehow haven’t managed to deduct your way down to a lower bracket, you pay $2,304 in state income tax. Conversely, the US income tax for that bracket is $9881. That’s a very sloppy calculation, based on $70,000 taxable income without all the typical deductions and such, but really it’s just to demonstrate the proportions involved. I can expect to pay a quarter as much to the state as I do to the federal government in income taxes. It’s a good thing that comes back through federal spending, right? Right?

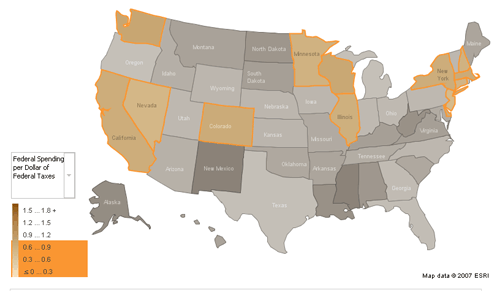

California produced $313,998,874,000 in gross tax revenue for the United States federal government in 2007. With a population of 36,553,215, that works out to $8,590 for every man, woman, and child. Meanwhile Missouri produced only $48,568,138,000 with their 5,878,415 people ($8,262 per capita). That’s OK, though; we have a progressive income tax, so states with higher typical wages will pay more taxes, and the difference isn’t really that high.

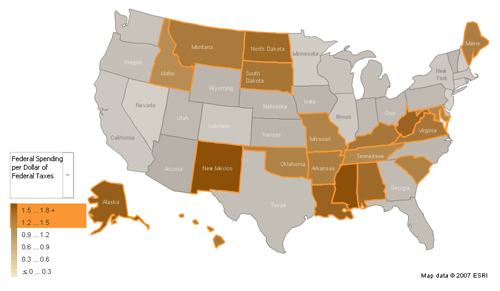

That said, we’re having to pull more of our weight internally than a lot of other states. For every dollar we pay into the federal government, we get $0.78 back. That’s $69,079,752,280 coming out of California taxpayers’ pockets that is landing in places like Missouri that gets back $1.29 in spending for every dollar of federal taxes they pay. Heck, it’s more than the entire tax contribution of that state by a significant margin. It’s also about 75% of our proposed state budget for next year.

I suggest that the Republicans in Sacramento have got it right: we don’t need to raise fees or taxes on Californians. I also suggest that Democrats in Sacramento have it right: we have much-needed health services, correctional institutions, and schools that really need to properly-funded. We need our representatives in Washington DC to start representing us better.

When the revised health care bill kicks its way back to the House of Representatives, Lynn Woolsey and other “progressive” Democrats should demand a better deal. If Woolsey isn’t going to get the public option she wants (much less single-payer), then she should get additional funding for the Palm Drive hospital in Sebastopol and the Sutter Medical Center in Santa Rosa. California should get the same kind of treatment Nebraska gets for Medicaid costs. If her party wants her to swallow her liberal principles to vote for an imperfect bill, she should bring home some bacon for her constituents.

The same goes for our other representatives of both major parties: put your constituents ahead of your party and secure funding for local projects. Your voters are paying for roads and bridges and schools and hospitals and army bases elsewhere, let that money flow back home.

*Mea culpa: I seem to have put a totally ludicrous figure on KC Meesha’s comments page about how much folks in Missouri pay per capita to the feds. I don’t know where that figure came from, but I noticed it while I was writing this up.

*edit: out of ignorance I had some gender pronouns wrong there.

Jools is an older tough lady from semi-rural Kansas, you can forgive her caps and punctuation :-). I agree that the system where some states get more of the federal money than others is unfair,it shouldn’t depend on the testicle size of your representative. However without looking up any facts I will propose that besides the unfair federal tax distribution, the reason for the current shortfall is that the spending was based on an unreasonable tax revenue generated by the real estate bubble. bubble is gone, someone should say-you know the money we thought we had was never there so our spending and contracts for the last 5 years were based on erroneous data and therefore are void,subject to review. it’s like you bought a house expecting your winnings from Nigerian money scam, so when it never happens you can’t have the house. lastly, representatives from California are the worst.

Oops, somehow it never occured to me that Jools was female. And I thought it was supposed to be “kids these days” that never learned their punctuation.

You may notice the lack of “Property taxes” in the general fund revenues chart. That’s because we have this thing called Prop 13 that strictly proscribes what the property tax rates are for whom and how the money gets spent. The real estate bubble generated a lot of money for cities, counties, and school districts, but not so much for the state itself.

I cited the dot-com bubble because that was the last time we saw incomes in the state rise sharply and the state had a big influx of disposable tax revenue. At the time, our state-level congress-critters passed a lot of legislation that called for guaranteed funding increases and such-and-such rates, based on then-current projections of state revenue that collapsed around them. The problem politically is that if you reduce a scheduled increase in something it’s perceived as a cut. Fail to increase spending in k-12 education at the proscribed rate and now you’re “cutting” education spending for our precious little children. Fail to bump up public safety funds and suddenly you’re cutting firefighter pay. These are all positions that politicians really cannot associate themselves with.

You’re right that a reasonable solution would be basically to say “See this old balanced budget we had last time we had this exact revenue? Yeah, we’re going to just use that again.” If would save a lot of time and effort by the legislative staff, that’s for sure.

And yes, my federal representatives suck. I’ve been encouraging them to do better and seeking alternate folks.

Yes, I’m an older, tough lady from semi-rural Kansas. I’m 63 to be exact and tough to the extent I have never taken one dime in any kind of hand-out from any government or anybody else other than salary and government services that are generally provided to everybody. Furthermore, although I may not worry too much about my grammar on a blog, I am not exactly illiterate. For your sake, I shall pen this comment as if I was still the Director of Regulatory Affairs for a major drug company.

My major point has been and still is that we cannot continue to live beyond our means and we cannot rely on others to keep bailing us out. I’ve seen several analyses of why California is broke and the dot.com bubble and the real estate bubble come up nearly every time as well as Prop 13. I’ll add to that another bubble that will cripple California, the pension bubble. How can any reasonable person believe that paying public employees to retire at age 50 with 90% of their pay for life be sustained? Let’s look at the private sector. I retired at 56 after 26 years of service with 20% of my pay for life. The formula was and still is based on your salary and your years of service, not the type of job you had or what state you worked in (we had several locations, including California). The company has been in business for over 100 years. Obviously, they know a thing or two about sustainability that California has yet to learn.

And, with respect to the bail-out, I am opposed to it because I believe California must tighten its belt more than it already has and cut spending further. A private company would have to do that or they would go out of business. I could agree with a loan from the federal government, however, until the state gets back on its feet. There is room for cuts. It will probably involve pain, higher taxes and cuts in service at least temporarily, but you must realize that the federal government is in bad shape itself. China is not going to keep financing our debt at the rate they are now. There simply is no more free money.

Yeah,give them Californians some well-deserved hell!

I would have to replace “tough” with “no-nonsense” to better reflect what I meant 🙂

I kind of like older, tough lady..haha. 😉 A challenge to my grammar (and implied intellect), however, raises my hackles. I’m over it though, and enjoy the debate.

I suppose I should have linked to this right off the bat, but the “90% retirement at age 50” thing is basically bullshit. CalPERS is the largest state employee pension group in California (in the country, as I understand it), and their retirement benefit info can be found here: http://www.calpers.ca.gov/eip-docs/member/retirement/service-retire/benefit-charts/pub-2-2percent-55.pdf

You’ll see that if you are 59 years old and have worked 40 years, you get 90% of your final pay as your pension benefit. That’s not age 50. The maximum a 50-year-old would get is 36.2% after working there continuously for 33 years. Jools, you would have gotten 53.66% with 26 years of work at age 56. Clearly CalPERS has better negotiators than you did (and California has worse negotiators than your company did).

Your pension was based on your salary and the amount of time you worked for your company. A CalPERS member’s pension is based on salary, age, and the time worked for the state. Varying by state is a non-question here, as CalPERS members working for another state are getting nothing from CalPERS for that time, just like you wouldn’t have received pension benefits for time you worked for some other random company.

So yes, California needs to tighten its belt. I suggest that we start trimming the fat with our surplus spending into the federal slush fund. Cut $20 billion out of Health & Human Services and have Washington pick up the tab for the similar services. Get the federal government, which is constitutionally obliged to handle immigration & naturalization pick up the tab on illegal immigrants that are in our jails and hospitals and schools. Loans aren’t the answer; it’s a systemic imbalance that needs a systemic solution.

Oh, and my general high-horse attitude regarding the imbalance of federal tax revenue really holds much more water with Missouri than with Kansas. Kansas only gets $1.12 for every dollar sent to Washington. I consider that to be well within the realm of “reasonable.” Compared to you, your neighbors to the West are a bunch of shiftless mooches. Who are taxing poor Meesha to death while they’re at it.

Jools, my apologies about the insult to your education and intellect. My intention was just to explain why I got peeved rather than to impugn your capacities. As I wrote that portion of the post, I felt it was necessary to explain why I was about to go off on a somewhat long tirade about a bunch of numbers, as people normally don’t do that.

Thank you. We just disagree on some issues. Your references look pretty sound regarding the pension issue. I don’t have the time, nor the inclination, to try to defend Will’s statement.

It seems the current administration is cutting deals with everybody for votes.

I have no doubt California will get what they want from Obama. I doubt the same would be true, however, if California was red.

Hey dude, was just searching through the internet looking for a bit of info and stumple across your blog. I am very impressed by the info that you have on this blog. It shows how well you understand this subject. Bookmarked this site, will be back soon. You, my friend, ROCK!!!