Earlier today I read something by the normally-insightful KC Meesha that has been gnawing at me for a little while now. He lined up a number of position statements attributable to a major-party presidential candidate and then commented on each one in a way that at first was somewhat comforting (thank God this man doesn’t vote), but then started itching at me (too many people think like this and vote). Gotta scratch that itch.

Let’s line a couple of points up and take a closer look, shall we?

[…]I support many ideas in theory but I am not doing anything about it. Where is a plan?

Specifically on the subject of abortion rights, at the federal level there’s basically nothing to be done other than put Supreme Court justices on the bench that will strike down Roe v. Wade or pass a constitutional amendment clarifying the constitutional place of patient-doctor confidence. Neither major-party candidate is looking to put anti Roe v. Wade justices on the bench, and the president of the United States has no constitutional role in the passage of constitutional amendments. This is a non-issue in 2008, just a cultural wedge people are using to drive people to or away from their polling places.

This immigration plan is ridiculous and unworkable and the fence idea is beyond stupid. Over 5,000 people got through much shorter and much better guarded Berlin Wall, so how can anyone expect a 700-mile fence to do the job. I am all for illegal immigrants (make them legal) as long as they 1)Pay taxes, except for Social Security since they cannot collect it; 2)Do not receive any taxpayer-provided assistance no exceptions;3)Obey the law. If they still want to come here and work I don’t have a problem. On the other hand if I were Obama I’d try do make everyone forget I voted for that joke of a plan and come up with something short, loophole-proof, frugal and usable. He can use my plan above for free. Not much change here.

Both major party candidates substantially supported the immigration plan in question here. Regarding Meesha’s proposed fix, most illegal immigrants pay taxes (they submit bogus identification to their employers who withhold payroll taxes and such that the employee will never see direct benefit from). It is nearly impossible to live in an industrialized society without drawing some benefit from taxpayer funds. We have socialized sewage treatment, water supplies, state-protected power monopolies, socialized roads, postal systems, et cetera. The second condition is ludicrous on its face. Perhaps if softened to a “no direct subsidies or special programs to specifically benefit illegal immigrants” we’d be back in the realm of the reasonable. As for the third point, illegal immigrants by definition have violated a law. Remove the illegality of the original entry (or overstaying of some visa or other) and they are roughly as likely to commit actual crimes as anybody else.

[…]I am not so sure straight troop withdrawal is such a good idea[…]

This is a widely-spread misrepresentation of Barack Obama’s Iraq policy. His stated goal is to “be as careful getting out of Iraq as we were careless getting in.” Whether you believe that or not is certainly up to you, but the only people that were arguing for a precipitous withdrawal were Mike Gravel, Dennis Kucinich, and Ron Paul (“We just marched on in, we can just march on out”). Attributing a straight cut-and-run disordered rout to Obama’s policy goals is ever bit as intellectually dishonest as the claims that John McCain wants to have a boiling insurgent conflict over there until the 22nd century. It just isn’t true and doesn’t match the candidates’ statements in any reasonable interpretation of their original contexts.

[…]I just don’t want it turned into something similar to the last days of Vietnam War. Someone smarter than me should devise a working plan to get out without putting American lives and property in danger.

Yes, that’s what generals are for. Tell them “Get our boys out safely, you have 18 months” and if they’re worth their stars, they get it done. If we cannot trust them to manage a withdrawal, we should not trust them to manage an occupation.

What kind of non-position is that? I don’t care about gay marriage as it is a non-issue for me.

Yes, it’s a non-position on a non-issue. So what? I don’t care whether a presidential candidate agrees with me or not on issues I don’t care about. I similarly don’t care if a candidate doesn’t care about issues I don’t care about. I’d much rather they held positions on important matters that are in their job description.

Workers of my age have been all but officially informed that were are not getting Social Security. Why not let me manage a tiny amount of my own money, mismanagement of the funds is one of the reasons Social Security is going down.

First, Social Security will still be there so long as the payroll tax is being paid by people that are still in the workforce. It will almost certainly not be able to pay out at the levels it is supposed to according to the current cost-of-living adjustment schedule. This is primarily due to the fact that the workforce is aging. The funds were only mismanaged in that the Social Security Administration has been purchasing extremely safe securities from the federal government (floating our deficits) instead of creating the incredibly touchy proposition of a government agency purchasing hundreds of billions of dollars of private securities on the open market.

Second, you can manage your own money. There are entire industries dedicated to people managing their money. Stocks, CDs, bonds, real estate, baseball cards, fast food franchises. Invest your money however you like. What Meesha probably meant here is that he doesn’t like paying taxes. Yeah. People don’t like paying taxes, but we also don’t like potholes and homeless elderly people all over the place.

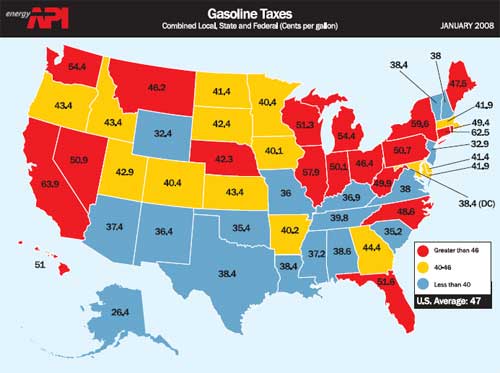

Raising taxes again. Not very smart but sure to please a lot of people. No change here, same old “tax the rich” song and dance.

Wait, doesn’t want to leave Iraq. Doesn’t want to pay Social Security taxes. Doesn’t want to raise any of the other taxes. So how do we pay the soldiers over in Iraq? With yellow ribbon car-magnets? How to we pay the people who are holding government-issued bonds? Print more money? That worked great for 1920’s Germany. It is politically infeasible to cut back our defense, Medicare, and Social Security budgets (the lion’s share of federal revenue goes to those three things) enough to cover our expenses without raising taxes. It is politically infeasible to raise taxes enough to support all the programs everybody wants. It is increasingly difficult to continue putting everything onto the national credit card. This is why we have professional bickering little sluts (legislators) duking it out all the time for us in Washington.

Cut defense spending and people will howl that we’re being irresponsible. Reduce Medicare and the health care infrastructure takes a huge hit as even more treatable conditions fall back to the emergency rooms. Touch Social Security at all and the AARP mafia will break your kneecaps (not literally, but old people vote, so politicians are afraid of ticking them off).

Raise capital gains taxes and homeowners looking to sell will cry bloody murder, investors will scream that new factories and shopping malls cannot possibly be built, no new jobs will be created, mobs of unemployed young people will rove the streets slaughtering the innocent, the gutters will run red with the blood of the innocent, chaos! Raise tariffs and prices at Wal-mart and Home Depot will skyrocket, sorely-pinched working people will be denied the affordable luxuries that keep them docile. Raise income taxes and highly-paid professionals will all decide to stay home instead of going to their quarter-million-dollar-salary jobs, and somebody will howl that a family consisting of a Firefighter and a School Teacher (capitalized because these are politically-sacred professions) will magically be in the top income-earning bracket despite their chronic representation as underpaid and under-appreciated public servants.

Taxes are touchy. The only thing you can say when running for office that is politically safe when this subject comes up is “my opponent is going to mishandle taxes terribly.” Democrats like to lean towards a policy of “we’re going to try to get the money out of the people that can best afford to pay it and have benefited the most from this country’s opportunities.” Republicans like to lean towards a policy of “we do not want to discourage the best and brightest from excelling, so everybody should pay the same.”