Logtar recently stirred up the pot a little on his blog by commenting on the evils of recent Republicans. That’s all well and good. There’s plenty of stuff for everybody to point fingers at. What got me riled up enough to participate repeatedly in the conversation that followed in his comments section was the notion that increasing taxes removes the incentive for people to do well, to outperform, to excel in their fields.

At first blush, this certainly makes sense: why should I try harder if I won’t get rewarded extra for it? Ah, but that isn’t what actually happens. If I bust my tail to make an extra $10,000 this year, the government will take away a portion of it. Let’s assume I am in the highest possible tax bracket already (because that is the strongest the tax deterrent gets, the deterrent is less pronounced at lower brackets). That means of the additional $10,000 I worked my keister off for, I have to give $3,500 of it to Uncle Sam. Those bastards. How dare they? Why did I waste my time? Oh yeah, because now I’m $6,500 richer for my efforts, have improved my standing with my coworkers and employer, elevated my reputation in my industry, made my kid proud of how awesome his dad is, and the thousand other reasons (including income) that I try to do well at my work.

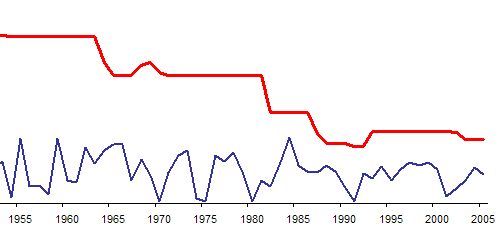

The chart at the top of this post shows the top marginal income tax rate in the United States from 1930 to 2005 (in red, the aggressive color of the evil government stealing your money) compared to the year-to-year percentage change in gross domestic product (in blue, the serene and peaceful color of economic progress and the production of wealth). Due to the sharp differences in scale, I put the GDP on a logarithmic scale. Forgive me. I put it together to see whether the common-sense argument really holds up. During my entire politically-aware life (from the later Reagan years onward) I’ve heard the same thing over and over again: the economy is being strangled by the tax system. High taxes are stifling our economy, preventing investors from doing their part, preventing businesses from expanding and innovating, and preventing small start-ups from hiring new employees and keeping our economy healthy.

The numbers don’t seem to support this. We see that when taxes are at or above 70% for the top income-earners, we see similar growth as when those taxes are are or below 45%, with wild variations that make it difficult to draw any causal correlation here at all. We know that when the tax rate on top-performers is 100% plus a trip to the GULAG (the old Soviet system) things don’t pan out that well, but when it’s 91% and the accolades and respect of the community, it seems to go pretty well.

Standing on soapboxes claiming that the nasty liberals are going to take away your cheese is, at best, bullshit. The problem isn’t how much the government takes from your paycheck, it’s what it turns around and spends the money on and whether we’re getting a good return on our investment. When Eisenhower used tax funds to build the highway system, private enterprise was able to take advantage of new infrastructure to build, expand, and optimize their private endeavors. When vocational training and after-school programs help kids stay out of trouble and get jobs, we don’t need to spend as much money policing and jailing. When billions of dollars just up and disappear because some government contractor isn’t keeping track of anything and nobody’s minding the shop in Washington, we just plain lose out.