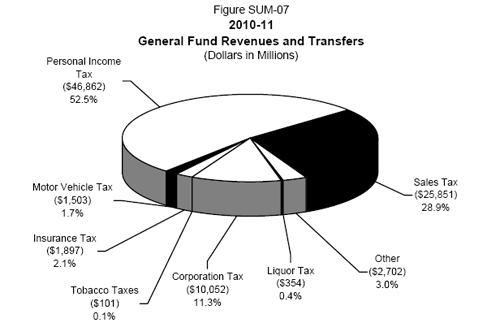

There’s been a lot of talk about excessive public pensions recently. A lot of it has been smoke and mirrors, with outrage about 50-year-olds retiring with 100% pay. I think it’s pretty obvious, if you calm down a little, that retirement packages for people in public safety roles that require intense physicality should be a bit different than for desk jockeys. If your house is on fire and your children are trapped upstairs, do you really want a ladder truck full of 63-year-olds to be your first responders? I didn’t think so.

Anyhow, it is true that public servants in California have pretty nice pension plans available. My wife, if she sticks around until she’s 55 years old, will be able to retire immediately with over half of her take-home pay and just about all of her benefits. That’s a big part of why it makes sense for her to stick around instead of seeking her fortune in the private sector. If we’re going to keep hiring new public employees, we’re going to have to attract them to their positions. We don’t conscript our DMV employees, so we have to pay them enough to get them to show up and stay and do their work. The current pension system is widely seen as an albatross around our state budget’s neck, but what should we do about it?

Let it burn. Keep the pension system substantially the same, and simply negotiate harder every time the public employee unions’ contracts expire. Here you run a serious risk of generating a lot of bad blood among the cogs that make the machine go forward. Work slow-downs and strikes would be more or less inevitable, and we could see a lot of our younger state workers simply jump ship for the private sector. This may not be the worst solution in the long run, but would require an inordinate amount of political courage.

Switch to 401(k). This tends to strike the general public and eminently fair. Private retirement plans in individual accounts are how most folks in this country build up their nest eggs, so why not public employees? Well, basically for the same reason that switching out Social Security for private accounts isn’t really feasible: without a continuing input of funds, the system dries up and leaves current beneficiaries stranded. These pensions are the result of negotiated contracts, and contracts have to be honored; if the state starts breaking its promises it cannot be trusted in future dealings like future labor negotiations, leases, or bond sales.

Two-tier Pensions. As a straight proposition, this makes a lot of sense, too. Existing employees are under and existing contract, so they keep their pensions. The state isn’t necessarily bound to extend those terms to new employees, so we set up a tier-two ghetto pension for new hires. This is probably how it will have to go down. I see the following levers that can be adjusted for our new second-class public servants:

- Years served. The CalPERS pension schedule allows for retirement after as few as 5 years. This yields a maximum pay-out of only 12.5% of salary, but when you consider life expectancy in this country, that can add up in a hurry. A person that works for a CalPERS position from age 58 to retirement at 63 can be expected to live to about 84 years old. That’s 7.6 years of pay for 5 years of work. By comparison, a 23-year-old that gets a job and holds it down until he’s 63 would keep 100% pay upon retirement. He’s likely to make it to 80 years old (from the same CDC data) and will draw down 57 years pay for 40 years of work. That ratio’s just messed up. Younger workers are a better pension buy.

- Retirement age. For positions that aren’t intrinsically hostile to older workers, bump down the vested portion of the pay scale way down for younger retirees. Fully-vested retirement payouts shouldn’t be available until the same age as full Social Security payouts. I think this is an option that most people looking to enter public service would recognize as reasonable, and would save the taxpayers years of personnel-years of double-pay for the same work.

- The definition of the salary basis. For most retired public employees, their pension payments are based on a three factors: the number of years worked, the employee’s age at retirement, and the highest full year of pay earned during that time. This last item is the biggest source of concern when enraged citizens write in to their local newspaper’s editorial staff. There are some high-profile people like city managers and department heads that pull down rather alarming salaries as their base, unmodified pay. That has to be dealt with on an individual basis, but a lot of other folks puff up their retirement rates artificially with last-year promotions and special bonuses. A police officer, for example, gets additional compensation for SWAT qualification. Transportation department workers get additional pay for working outside where they are exposed to traffic. A lot of these bonuses are cumulative and become quite substantial. Maybe they shouldn’t factor in for retirement purposes; make the base pay for pension payouts exclude these bonuses and a fair amount of the anger-inducing individual pensions become much more palatable.

Assuming the politicians, voters, and union members involved aren’t willing to take the “let it burn” option, it seems that introducing a second-tier pension plan with adjustments to the retirement age and years served factors, along with an adjustment to how the basis pay is calculated is a pretty reasonable way forward.