My old buddy Morte posted today about the death of the Presidential Election Reform Act. Since statehood, California has gone with a winner-takes-all approach. Given the size of California, with its 53 representatives in the House and two Senators, that’s quite a prize for whichever candidate can scratch out one more vote than any of his competitors.

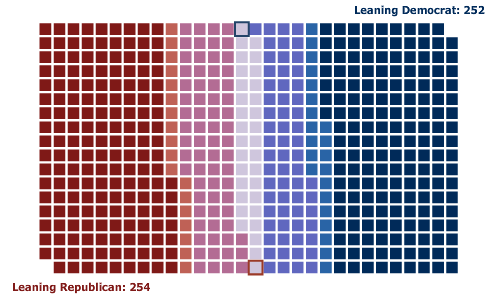

The main objection I’ve heard regarding the recently-stalled proposal was that California would effectively be throwing a bundle of electoral votes to the less popular candidate. The basic underlying assumption here is that next year Californians will mostly queue up to vote for whoever the Democratic candidate is for president. Since the Presidential Election Reform Act divvies up votes by congressional district, this means that a handful of Republican ghettoes, products of decades of political gerrymandering, would yield electoral votes to whoever the Republican candidate is. This would detract from the avalanche of Californian Electors lining up to back the Democrat.

Basically what we have here is two political parties trying to decide the election before the election. Each sees the current system rigged in the Democrats’ favor this time around, and each has a strong preference in the outcome. I totally understand that and expect it. The debate over

For the record, I favor initiatives that distribute electoral votes proportionate to the popular vote, rather than by CD or winner-take-all. Of course, doing that way would make the Electoral College redundant, and why would anyone in their right mind want to make an archaic institution appear redundant?

Does this mean that he would favor a percentage of Californias 55 Electors be determined by the corresponding percentage of Californians that vote that way? In 2004, this would have resulted in 30 going to John Kerry, 25 to George W. Bush. In 2000, this would have resulted in 30 going to Al Gore, 22 going to George W. Bush, and 2 going to Ralph Nader.

Small problem: if counted by congressional district instead of by statewide proportion, Bush would have only recieved 19 electors from the Golden State in 2000. By proportion, he would have received even more. There wouldn’t have been a change in outcome in the 1996, 2000, or 2004 elections, but the Bush presidency would have had a stronger air of legitimacy. For somebody as clearly and consistently allied with the Democratic party line, my old friend appears to have strayed. Or did he?

Two alternate solutions that may better suit the delicate sensibilities of a 21st-century liberal type:

- Instant runoff: Let the people vote for who they really want. Rather than check a single box, rank the candidates in order of preference. If you really like that Green Party candidate but are afraid the Libertarian will win, just make sure you put your fall-back candidate into the mix. Once it has settled down to somebody having an actual majority of votes, hand the 55 electors over and congratulate the hard-fought campaigner. I bet Nader and Badnarik would have received a lot more votes had this been an option. Instant Runoff has been slowly gaining ground at the local level, and may be viable at the state level soon.

- National Popular Vote Interstate Compact: let the national popular vote stand as the true vote of the land. The basic concept is that if enough states agree to cast all their electoral votes to the winner of the national popular vote, the Electoral College becomes entirely redundant. Maryland, with 10 electoral votes, is the only state currently pledged to participate in this scheme. California’s attempt to join in on the pact was vetoed in 2006 by our beloved governator.

The Presidential Election Reform Act failed largely because Californians have given up on our congressional districts as being hopelessly gerrymandered. The Democrats and Republicans have constructed for themselves safe seats in the state and national legislatures. Could tying presidential election success to our congressional districts lead to a serious re-thinking of how we draw up our district boundaries? I don’t know, but it would have been interesting to see the chaos in Sacramento had this measure shown up on the ballot.